FSA & HSA Eligible

Shop NBI Products with Tax-Free Dollars from Your FSA or HSA

It's easy! Here's how:

- Purchase eligible products.

- Save your emailed receipt.

- Submit to your benefits provider for reimbursement.

-

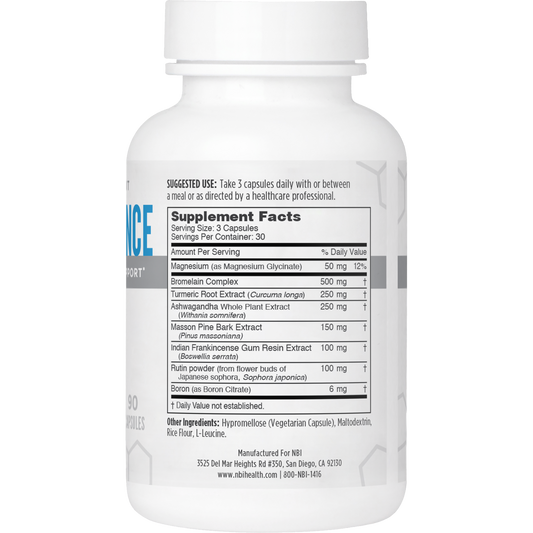

FSA & HSA Eligible

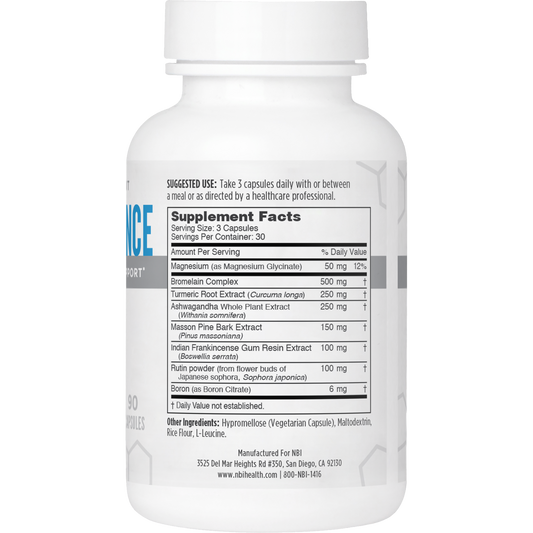

FSA & HSA EligibleArthro Balance

4.857142857 / 5.0

(7) 7 total reviews

Regular price $32.95Regular priceUnit price / per -

FSA & HSA Eligible

FSA & HSA EligibleBest Catch Omegas

4.8 /

(0) 0 total reviews

Regular price $42.95Regular priceUnit price / per$0.00Sale price $42.95 -

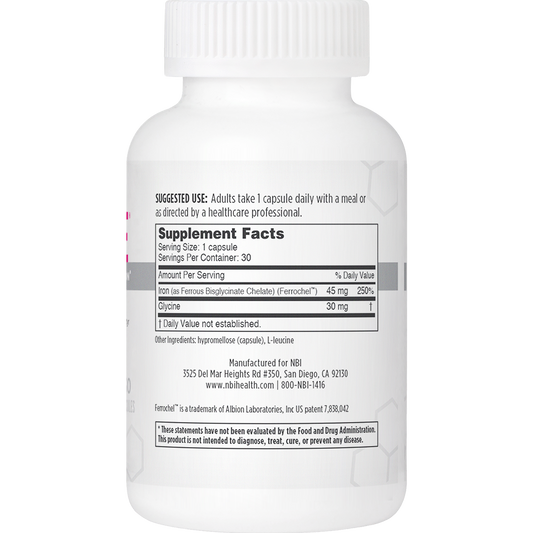

FSA & HSA Eligible

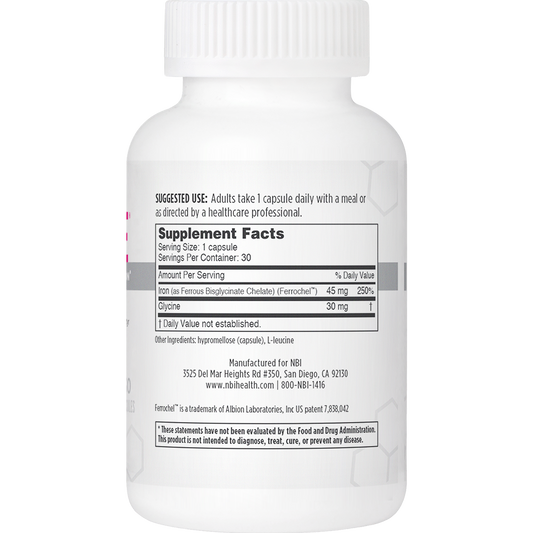

FSA & HSA EligibleFerroSolve

5.0 / 5.0

(16) 16 total reviews

Regular price $20.95Regular priceUnit price / per -

FSA & HSA Eligible

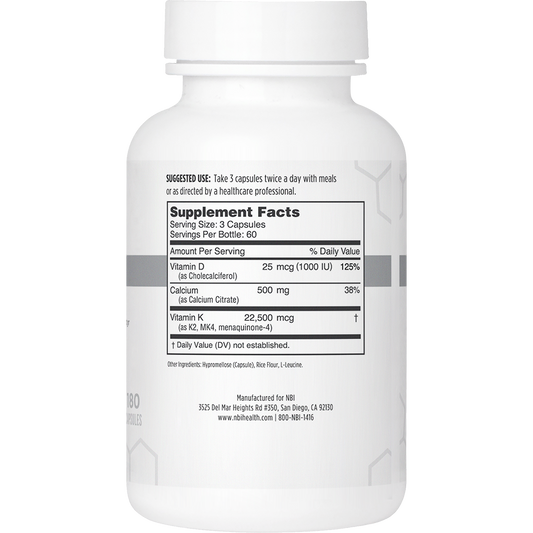

FSA & HSA EligibleOsteo-K Minis

4.956521739 / 5.0

(69) 69 total reviews

Regular price $65.95Regular priceUnit price / per -

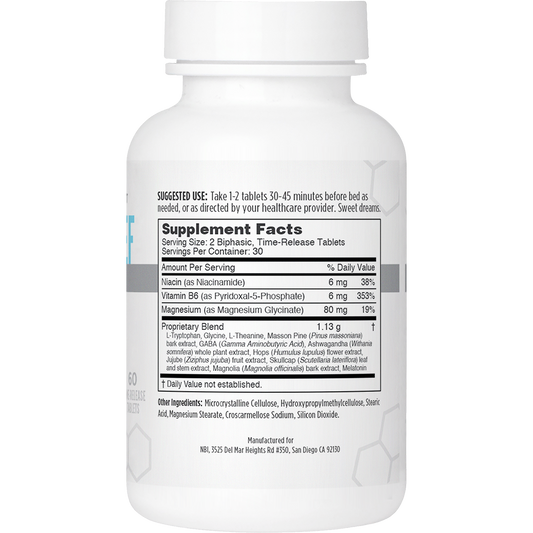

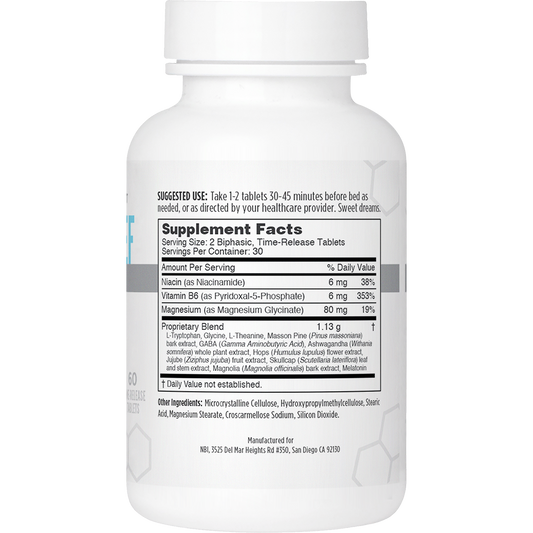

FSA & HSA Eligible

FSA & HSA EligibleSleep Relief

5.0 / 5.0

(26) 26 total reviews

Regular price $40.95Regular priceUnit price / per

Learn More About FSA & HSA Spending on Eligible Products

What are Flexible Spending Accounts (FSAs)?

An FSA, or Flexible Spending Account, is a type of savings account offered by some employers. It allows you to set aside a portion of your pre-tax income to pay for eligible out-of-pocket health expenses. This means the money you contribute to your FSA is deducted from your gross income before taxes are calculated, resulting in significant tax savings. FSAs can help you cover costs not fully covered by insurance, such as deductibles, copayments, and certain over-the-counter health products and certain dietary supplements.

What are Health Savings Accounts (HSAs)?

A Health Savings Account (HSA) is a tax-advantaged savings account specifically designed for individuals enrolled in a high-deductible health plan (HDHP). Contributions to an HSA are made with pre-tax dollars, reducing your taxable income. The funds can be used tax-free to pay for qualified health expenses, such as deductibles, copayments, and prescription medications and certain dietary supplements. Unlike FSAs, unused HSA funds can be carried over from year to year and invested for potential growth, making them a valuable long-term savings vehicle for healthcare costs.

What items are eligible?

Both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can be used to pay for a wide range of qualified health expenses, including doctor visits, hospital stays, prescription medications, dental care, vision care, mental health services, dietary supplements when prescribed by a healthcare provider, and more. However, it's important to note that not all health expenses are eligible, and specific rules and limitations may apply depending on your individual plan and IRS guidelines. For background on qualifying health care products and FSAs and HSAs in general, please visit Publication 969 of the IRS here.

How can I use my FSA/HSA to purchase products?

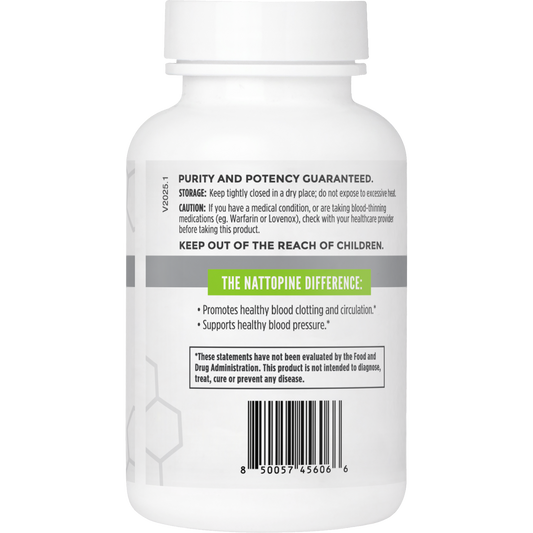

To use your FSA or HSA for dietary supplements, you'll typically need a prescription from your doctor. This prescription, often called a Letter of Medical Necessity (LMN), explains why a product or service is necessary for your health. A licensed healthcare provider can provide an LMN, which can help you access HSA and FSA money toward your health purchases. The LMN helps prove to the benefits administrator that the product, such as Osteo-K, Osteo-K Minis, Osteo-MK4, Best Catch Omegas, FerroSolve, Calm + Clear, or Sleep Relief are necessary. With this documentation, you can purchase the supplements and submit a claim to your FSA/HSA administrator along with the prescription and receipts for reimbursement.

What happens if I need to make a return on an FSA-/HSA-eligible item?

If you have filed for reimbursement for a purchase of an FSA- or HSA-eligible product, you will need to reach out to your benefits provider and determine if there any specific procedures and restrictions,

The content provided is from other public sources and has been reproduced here for educational purposes only. This information does not take the place of advice from your benefits provider or tax advisor. If you have questions about your FSA or HSA, please reach out to your employer, benefits provider or accountant.